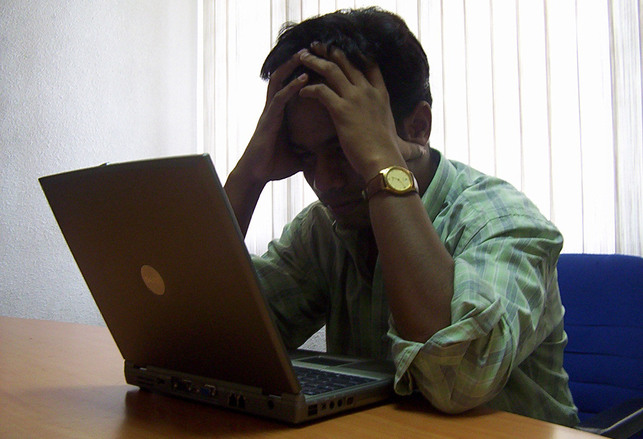

image Rajesh Sundaram

Joe Schmo investor out there doesn’t know what he’s doing. He’s stuck in his own bad investing behavior.

It’s not really Joe Schmo’s fault. We’ve been taught our whole lives that they way to win at investing is to gamble on the stock market and strike it rich. We think we need to get lucky. We think the game is to guess which stocks will win based on news and tips from friends. We try to chase individual stocks as they rise and fall. We try to outsmart the market. We try to pay high-powered Wall Street brokers to let us in on some secret. That’s all bad investing behavior. That’s Joe Schmo stuff. Very few people actually get market returns, they get market returns minus high fees and lose more money from impulsive lizard brain behavior.

It’s time for good investing behavior.

This is what it looks like:

Academic research + discipline and patience + tactical planning = Significantly better cumulative returns through evidence-based investing

The academics have already figured out the best way to put the odds of the stock market in our favor. We just need to listen and execute.

Using evidence to invest in long-term performance that will likely smoke everybody else out there? That’s good investing behavior.